Former Intel CEO almost bought Nvidia for $20bn: Here is why it didn’t happen

In 2005, Intel came close to making one of its most significant moves ever—acquiring Nvidia.

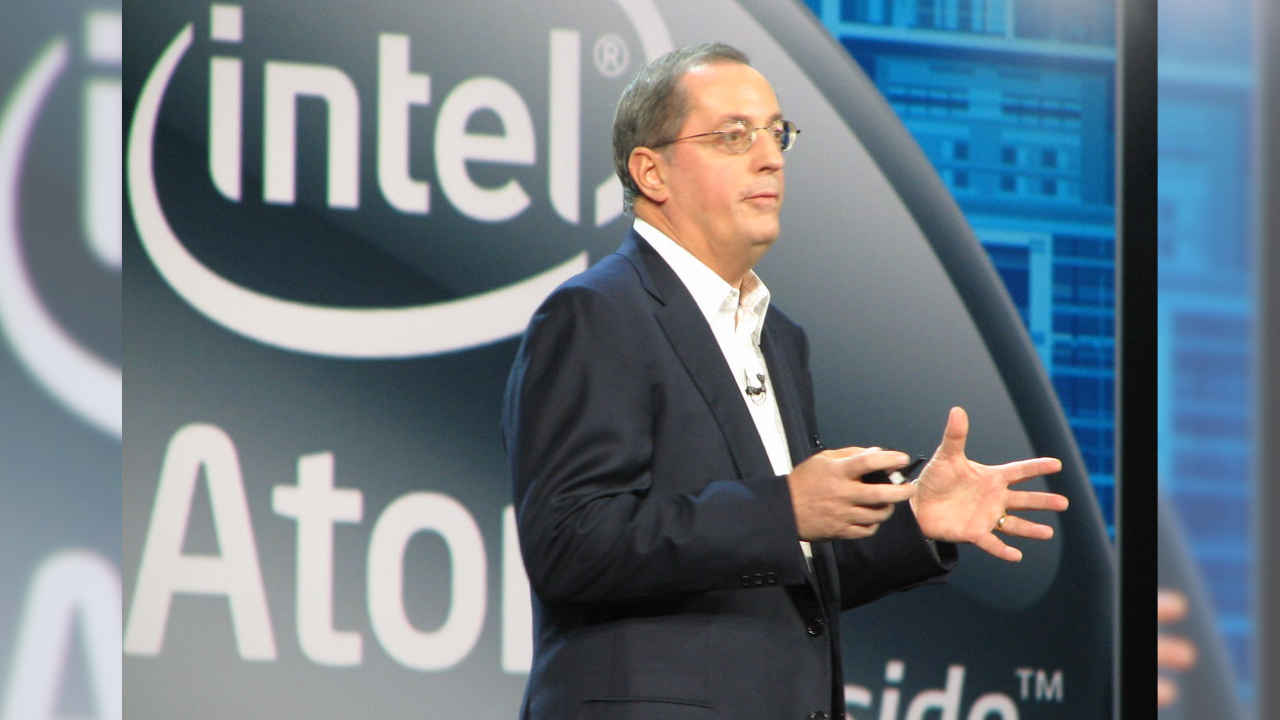

Intel’s then-CEO, Paul Otellini, had a bold idea: buy Nvidia for up to $20 billion.

Concerns about how Intel would integrate Nvidia, especially given the size of the acquisition, led to hesitation.

In 2005, Intel came close to making one of its most significant moves ever—acquiring Nvidia. Intel’s then-CEO, Paul Otellini, had a bold idea: buy Nvidia for up to $20 billion. However, despite his confidence, the idea never materialised, and Intel went in a different direction.

Survey

SurveyAccording to a report from the New York Times (via Tom’s Hardware), Otellini presented this plan to Intel’s board, surprising many. Two people familiar with the boardroom discussions said some Intel executives saw potential in Nvidia’s designs, especially for future data centres. This prediction would eventually prove accurate with the rise of AI technologies. However, Intel’s board didn’t share this enthusiasm. Concerns about how Intel would integrate Nvidia, especially given the size of the acquisition, led to hesitation.

Also read: Intel to layoff over 15,000 employees as part of its $10 billion cost-saving plan

At the time, $20 billion would have been Intel’s largest purchase, and the risks seemed too high. In the end, Otellini backed down.

Instead of pursuing Nvidia, Intel chose to focus on its own internal project—Larabee. Led by Pat Gelsinger, who is now Intel’s CEO, Larabee aimed to create a graphics processing unit (GPU) using Intel’s x86 technologies. This hybrid CPU-GPU project, however, did not succeed, and Intel eventually abandoned Larabee. While Intel later returned to the graphics market with its Xe and Arc projects, the missed opportunity to acquire Nvidia became more evident as the AI industry boomed.

Also read: Nvidia eyes India as AI export hub, partners with Reliance and other Indian IT giants

In the AI space, Intel did make some acquisitions, including Nervana Systems and Movidius in 2016 and Habana Labs in 2019. However, these deals did not match Nvidia’s rise. Nvidia, now valued at over $3 trillion, dominates the AI chip market, while Intel, with a much smaller market cap of under $100 billion, is still playing catch-up with its Gaudi 3 AI chip.

Interestingly, this wasn’t Intel’s only missed AI opportunity. In 2017 and 2018, Intel had a chance to invest in OpenAI when it was still a small non-profit. But then-CEO Bob Swan passed on the deal, doubting the near-term potential of AI models.

Ayushi Jain

Ayushi works as Chief Copy Editor at Digit, covering everything from breaking tech news to in-depth smartphone reviews. Prior to Digit, she was part of the editorial team at IANS. View Full Profile