How to get your startup off the ground?

We’re pretty sure that our magazines July issue based on launching your own startup inspired you like Leonidas inspired his 300 to defy all odds and charge through the hills. While you didn’t slay any Persians (we hope), you probably put on your thinking cap last month and came up with that one startup idea to rule them all. An idea that will dramatically alter the world as we know it. An idea so big even Zuckerberg will sit up and take notice! But hold on, let’s not book that Ferrari just yet. An idea is just the starting point. Strap in…the ride has just begun.

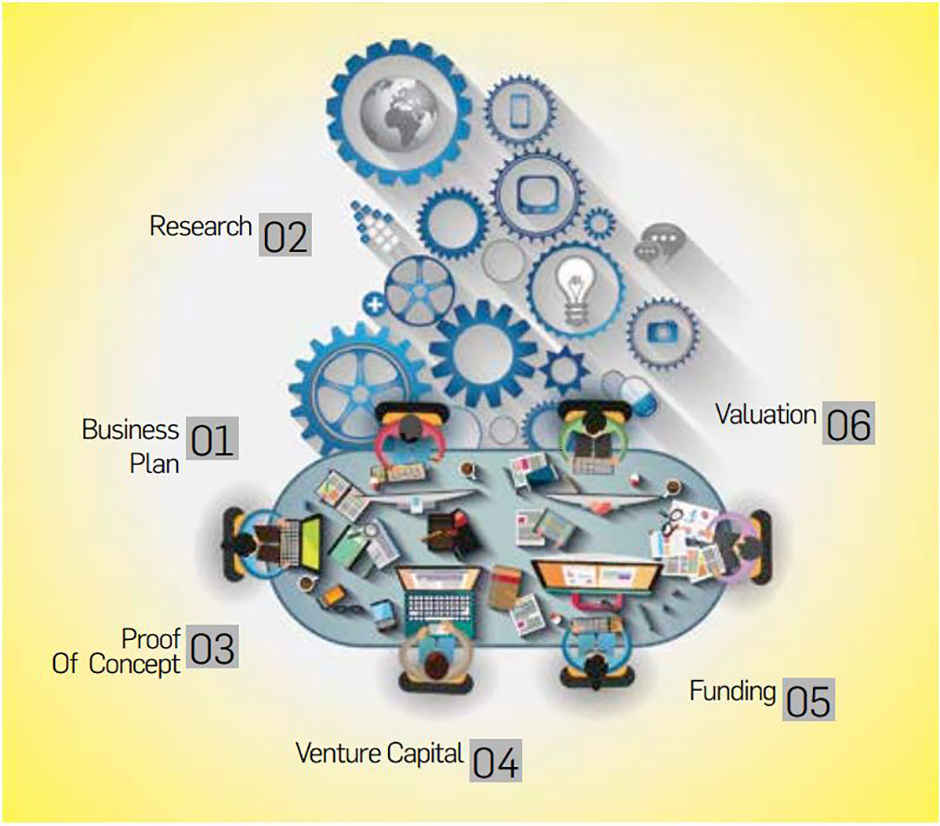

Create a stellar business plan

Formulate a sound strategy and vision statement

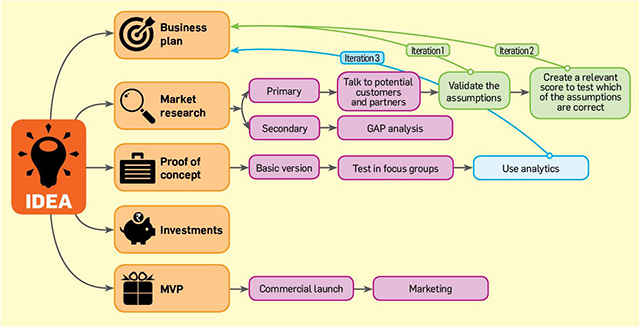

As Sam Altman of Y Combinator says, “Good execution is 100 times more important than a good idea and more difficult”. The first step to good execution is a well documented business plan. Most founders, however, especially the geeks, spend more time on product development than on a strategy. Unless you’ve designed a product like the Tesla car or Twitter, you’ll need to have a sound strategy in place (no disrespect to Elon Musk and Tesla, they do have a great strategy). Since a business plan is considered as a blueprint to your success, it can be a daunting task. A mind map tool like ‘Mindmeister.com’ can help you get your thoughts in order and eventually hash them out into a cohesive plan. An important point to note is that there will be several iterations of the plan as you progress.

There are several components of a good business plan. A good vision statement is crucial. Everybody – your investor, employee and consumer – gets behind something that’s larger than life, something that includes and inspires them. It should encompass a dream, a solution. Chew on Amazon’s mission statement: “Our vision is to be earth’s most customer centric company; to build a place where people can come to find and discover anything they might want to buy online.” Coming back to formulating a strategy, you need to remember that the devil is in the details. Talk about your product in depth. As you hash it out, you’ll discover some of the important points you missed and redundancies that are present. The next step is to do a thorough competitive analysis. Know thy enemy is the mantra given to us by Sun Tzu in the now immortal Art of War. It one of the cornerstones of victory in any battle.

|

The Geek Way To Master Business Plans |

|---|

| We’re geeks. We’re Google wizards. And we’re pro-convenience (not lazy). As it turns out, there are several online repositories available with tons of readymade business plans across verticals that you can tailor to your needs. Follow this link for one such site. You can also download templates here and here. |

Advertise your product, because it won’t sell itself

Marketing strategy is another commonly ignored aspect. Say, you’re a tech guy – the coder who’s built this revolutionary app, and you believe in your product. Although we don’t know yet whether your product is indeed great, we’ll consider for the moment that it is. There’s a misguided belief that a great product will market itself. Don’t fall for it. A consumer will buy only what he knows. Unless you have a plan to bring your product or service to the consumer’s notice, it’s not going to be sold. You also need to be able to convince them why they need it. In the course of researching this article, we had the opportunity to speak to Vinay Rao, CTO of Venture Factory. His company does something quite interesting – it can be thought of as a production line for creating ventures with factory-like quality processes that aim to eliminate flaws in startups at a very early stage. Vinay has himself invested close to $10 million as an angel investor in various startups. He aptly says, “Entrepreneurs shouldn’t forget fundamentals. It’s super important to find a product that sells and a product that makes money rather than just customer acquisition”.

Let people know you exist!

Form your core team

Last but not the least, we need to consider the core team. A startup is driven by its founders and employees. Their skills, expertise, determination and commitment is directly proportional to the startup’s success. Be sure to find a Watson to your Holmes. You may be a dead shot like the Sundance Kid, but you need a Butch to lead the team. If you’re looking for a co-founder and technology is your niche, you don’t necessarily need to look for someone with non-technical skills only. They can maybe complement your skills or knowledge areas like Wozniak and Jobs or Larry and Sergey. Form a team, whose calibre covers all the major aspects of your business. An ideal composition would be a strong leader, a technical expert, sales and marketing guy and a number cruncher. While building your team think of an HR strategy, the culture you want to develop and the attributes you’re looking for in an employee. Be careful with selecting team members. Look for someone who will stick with you through the bumpy parts, not abandon ship at the first sign of trouble.

The iterative process of making a perfect business plan

Research – Do your homework

Learn about the competition

Do a Google News search on your industry and read every article you can lay your hands on. It’s the most effective way to hack secondary research. Slowly, you’ll have a bird’s eye view of the market and be able to better understand how it works. The main part of your industry research will be studying your competitors. Even if you’ve created a unique product, you’re most likely providing a substitute to another product/service. E.g. personal computers were unique, but they were a substitute to typewriters, calculators and a host of other devices. Or look at the ‘Hövding’ helmet – despite how extraordinary the idea is, it replaces the traditional helmet. In the words of marketing guru Al Ries, you’re creating a new category or using the “power of divergence”, as he calls it. So, your current competitors are the products you’re hoping will go obsolete as a result of your invention. Indirect, but still competition. Use their services, enter into a dialog with them. Through their website or sales contact person, they’ll inadvertently divulge information on the market. A caveat: take this advice with a pinch of salt.

Interact with potential consumers and partners

Then, speak to potential consumers and possible alliances as well. Say you’re launching a platform for the medical community that brings together all medical practitioners on a single page or connects patients to medical services, like Practo. You’ll talk to patients who’d be interested in using your services. You’d also talk to doctors and pathology labs, among others, to understand their support for such a program and sign them up. While having this conversation, you’ll not only understand what its selling features are, but also derive a growth hack. These partners in turn become your POS (point of sales).

|

PROTIP – GET THE 20-20 Vision |

|---|

| To inspire your potential stakeholders, you need a perfect vision statement. Forbes has done a fantastic job of explaining why most company vision statements ren’t effective. Read it here. Now you know what NOT to do. But you still need to know how to get it right. For better understanding on formulating a vision statement, go here |

Do your primary research

Social media is a great tool for primary research. Tools such as Facebook, Twitter and Whatsapp allow you to connect with many people from all demographics across the country. Running a Facebook ad for a few weeks will prove to be cheap and insightful. Doing this will allow you to talk to your potential customers in their comfort zone where they’ll be more open. The earlier stage when you have personal interactions acts as a good starting point and the start of a partnership. However, asking people for their opinions and feedback in real time puts them on the spot and most people don’t like to be exceptionally rude and discouraging. So you might walk away with a hunky dory impression.

Always, take findings from personal interactions with a grain of salt. As Vinay says, “What people say is not what people do”. Create a benchmark score to understand which product components the users like and which they don’t. Facebook rates the effectiveness of your ad campaign on a scale of 1 to 10. The closer to 10 you are, the better the ad was received by your target audience. So you can create multiple ads highlighting the different features of your product and run them across your target demographic. The one that attracts the most consumers is the feature that you should ideally focus on. Primary research is mainly used to validate your assumptions of the consumer’s needs and product value propositions. Now go back to your original plan and incorporate these findings.

Validate your assumptions by quality research methods!

Proof of Concept (POC)

By this stage, you should be able to create a basic version of the product. This will include only a couple of the value propositions that have been validated. This is your “proof of concept” or “POC”. To know whether your concept has real-world application, it must be tested. To test this beta version, form a focus group, usually consisting some of your potential customers and the partners you spoke to during the research phase – they’ll most likely agree to do this. Generate plenty of feedback in the beta testing stage. Some of the key questions you should seek to answer are: “Where’s the consumer coming from?”, “Where are they spending time?” and “What’s their next step?” To answer these questions, assuming you have a website-driven product, use Google Analytics to analyse the pattern and flow of visitors. If not, create custom surveys and ask your customers to fill them out. This should give you the final iterations to your business plan. Once you’ve developed a POC, you’re good to approach Angel investors to move to the next stage.

Who are these Angel investors?

An angel investor is a high net worth individual (HNI) who’s willing to place a bet on you and your idea. Basically guys with a lot of money to throw around. Of course we kid, they’re shrewd as hell, which is why they have all that money in the first place! Most of these angel investors are entrepreneurs or tycoons themselves like the Bansals of ‘Flipkart’ or Bhavish Aggarwal of ‘Ola Cabs’ or Aprameya Radhakrishna and Raghunandan G of ‘Taxi For Sure’ fame. Remember, any entrepreneur who has made it big can be a potential angel investor – be it your very own rolling in money landlord or hero worshipped cricketers such as Yuvraj Singh (who has created the ‘YouWeCan Ventures’).

Even industry stalwarts such as Ratan Tata and Narayan Murthy, who set up ‘Catamaran Investment’, are known for their angel investing on the side. There are also crowdfunding initiatives such as ‘Kickstarter.com’. Online platforms such as ‘Paisaconnect.com’ host a portfolio of investors to view and approach. Indian Angel Network provides a platform for the angel investors to come together and create a bigger fund. Fund houses such as ‘Sequoia Fund’ are also beginning to ride the angel investment wave.

Start looking out for your Angel Investor right now!

Venture Capitalists (in the years to follow)

A few years later, you’ll want to grow further, maybe by expanding geographically, adding more product lines or beefing up your development/engineering and marketing team. This is where the venture capitalist steps in. Venture Capital (VC) firms are always professional funds that raise money from HNIs. They’re always on the lookout for a company to invest in and generate returns for their clients. Funds from such firms are injected in three rounds called Series A, B and C funding rounds.

According to ‘YourStory’, India’s media platform for entrepreneurs, $3.5 billion was injected into 380 disclosed deals in the first of half of 2015. Also check out this as well as this for a deal by deal account compiled by trak.in.

Minimum Viable Product (MVP)

Next, you move to the commercial launch with the “minimum viable product” or “MVP” (since techies just love acronyms). To ensure users are aware about your product, you must start marketing your product through the channels identified during the earlier stages. By this time, you’ve gone through several product iterations, incorporating the suggestions gleaned from the market research, beta testing and your own ideas. Now the product is ready to be released to the public. This is the acid test. Now the horrid waiting period starts as you wait for your first non-focus group consumer. Remember, there still might be some flaws in the product so continue testing it. It is called minimum viable product for a reason.

Vinay Rao suggests, “Once the people are onto your platform, it’s super important to keep measuring”. Keep running analytics, understand the consumer’s needs – they’re always dynamic. Keep improving it. At no point in time throughout the life of the product can you say “That’s it. It’s done!”. “No more developments, no more changes”. That’s a death knell. You need to keep innovating and evolving. Don’t be anchored to your original idea, be prepared to cut down on features. Be brutally honest with yourself about the product. Emotional attachment to the company is good but it shouldn’t translate to blind faith of the product. When Kevin Systrom and Mike Krieger were developing Instagram, they reduced more features than they added. In fact, their original idea included check-ins to locations and future check-ins (make plans), among other things – all of which were scrapped till they were left with a neat photo-sharing app.

How funding works

Apart from the fact that it’s currently the cool thing to do, the reason for funding is more primeval – to earn a profit. Before any funds are invested into it, your company is assigned a valuation called “Pre-money valuation”. “Post money” is a simple addition of premoney valuation and funds invested. As you can see in the table, at the end of Year Five, when the VC steps in, the angel investor’s equity stake has gone down to 15%, however its value has increased to Rs.6 crore.

Choose wisely who your investor is!

Various stages of the funding process

The funding process/lifecycle is pretty straightforward: pitch, discussions, term sheet, final agreements and eventual exit. The pitch is where you initially present the idea to the investors. If they’re interested, you discuss the business in greater detail. Once they’re onboard, they’ll give you a term sheet. A term sheet is a nonbinding (i.e. non-enforceable document) that outlines the terms under which the funding will take place, the amount, equity, corporate governance etc. This document provides a broad overview of the basic points of the deal without going into its nitty gritties. As such, it’s the most important document before the actual agreement. You can check out a term sheet generator here (Didn’t we say we were pro-convenience?) Although it’s more US-centric, you’ll still understand the various points you’ll need to think about. Post this, you enter into the final negotiations and eventually sign the final agreement.

In case of exit…

Be careful while choosing the investor. You don’t jump in with your eyes closed into a marriage; this is no different. The last thing you want to do is work with an investor who doesn’t share your vision, is too controlling and isn’t in it for the long haul. It’s a good idea to have a buyback clause in the agreement. This essentially means that after a certain agreed upon period known as the “lock-in period”, you can buy back the investor’s stake. Of course, this isn’t the only exit strategy that the investor has in place. Another one of the three ways in which this can be done is for the investor to wait for someone else to come in and buy them out.

For example, ‘Taxi for Sure’ was acquired by ‘Ola Cabs’. Other methods include an IPO or a VC. The surest and fastest way is by buyout by a VC, however, this doesn’t usually happen at the Series A funding stage (the first round of VC funding). A new investor coming in would obviously not want the money to go out of the company to line somebody else’s pockets, they’d want it to be used for growth. Plus, it gives them assurance of quality if the previous investor stays put. Of course, there would be a dilution of everyone’s stake.

Safeguarding your company

On the subject of stake, one burning question you’d have by now is “How much stake should I, as the promoter, keep?” To some extent, it depends on your product and market, and to a large extent on the industry norms. An angel investor typically takes around 15% – 25% stake in the company and a VC around 30% – 40%. At the time of VC funding, the promoters should hold around 50% – 60% stake in the company. Thankfully, due to the upsell requirements, there’s little risk of the angel investor trying to undercut the promoters. To benefit from returns, VCs need to invest, so they’ll invest only if there’s a great story. So, what makes a story great?

| Year | Stage | Valuation (in Crores [INR]) | Stake |

|---|---|---|---|

| Year 0 | Pre-money | 4.00 | |

| Year 0 | Angel – Funding | 1.00 | |

| Year 0 | Post – money – 400+100 | 5.00 | |

| Year 0 | Angel stake – 100/500 | 20% | |

| Year 5 | Pre – Money – | 30.00 | |

| Year 5 | VC Funding | 10.00 | |

| Year 5 | Post Money – 30+10 | 40.00 | |

| Year 5 | VC stake – 10/40 | 25% | |

| Year 5 | Revised Angel equity – 40*20% | 6.00 | |

| Year 5 | Revised Angle stake – 6/40 | 15% |

A ginormous factor that determines this is the promoter’s continued interest in the welfare of the business, which happens only if (yes you got it) they have a substantial piece of the pie. Another factor is an option pool, usually of around 10%. These are employee stock options that you provide to your early employees as an incentive to stick their necks out for you. This is also an important part of the “story” as it means that you have a committed core team that will stick with you till the end. These ESOP’s (employee stock ownership plans), as they’re called (Yes, finance geeks also love their acronyms), come with a lock-in period so no one can just jump ship. Now that we have all that out of the way, let’s see how to get the ball rolling.

Pitching to investors

If you think you’re smarter than the investor and can just dazzle or laud him with platitudes and pontification, think again. They’re extremely smart. Irrespective of what Rahul Yadav says, don’t take them lightly. Before entering the meeting, you should be ready with thorough research on your industry, its history, growth prospects (as shown by leading market research companies) and competition. Presenting to investors without hard market data to back you up is like no-scoping in Counter-Strike world league without ever firing a Deagle at your local cyber cafe. No matter how great you think you are, you’re going to get shot down. In the first few seconds. Now the time spent on the tedious business plan seems worth it, doesn’t it? When pitching, honesty eventually turns out to be the best policy. Expect to be grilled like a well done steak.

Keep all the answers to their questions ready!

Starting with why your product or service is needed. The investors love to play the devil’s advocate. This is where you use your finely honed weapon of research. Typically, they’re looking for answers to questions like “What's the idea?”, “What’s the gap you’re addressing?”, “Does this idea represent a need-at-any-cost solution to the consumer or is it a latent demand?”, “What's the market size and growth rate?” and “What are the chances and methods of future monetisation?” A word of caution here: Most entrepreneurs in their unbounded enthusiasm consider the entire 6 billion population or a huge chunk of it as their potential market. Then they derive that only a miniscule size of this is required to achieve a billion-dollar company. Nothing will send investors running to the door faster. Be realistic of your market niche and talk about a specific segment. If you want it straight from the horse’s mouth, take a look here.

How to value your business

So you’ve managed to interest the investors and are discussing how much investment you’ll need. This raises a very important and sticky question: What is the valuation of your company? Although seemingly innocuous, this would be the most important question your startup has faced. Undervalue and you’ll have a cascading effect all your life. Apart from getting less than what you’re worth, you’ll always be hampered by this in all subsequent funding rounds. Over valuation, although attractive, will drive away future investors.

‘Discounted Cash Flow’ model is a traditional approach involving a lot of projections and forecasting of revenues and profits for the next 5-7 years to arrive at a number. For this reason, it isn’t a preferred method for valuing startups. ‘Comparables’, as the name suggests, takes a metric core to that industry and multiplies it by a revenue number. This number is arrived at by looking at other deals in the same space with the same dynamics. The comparable metric is different for different industries.

Avoid undervaluing or overvaluing of your business.

In the hotel industry, the revenue per room is taken as the metric core and this is multiplied by revenue per room. Comparables played a big role in the valuation of Whatsapp and Instagram. Revenue (in dollars) was multiplied by number of users. There are several more schools of thought on this, but the crux of it lies elsewhere. Does all this sound a bit too hocus pocus? Like staring into a crystal ball, rolling your eyes and spouting a number in a deep, enchanting voice? Pardon the histrionics, but valuation is generally considered more an art than a science. Since at this stage, there’s a dearth of hard data, emphasis is on qualitative factors.

The idea is at the top of the list of any investor. It should have identified a gap and be providing a solution to fill that gap. They want to see your vision, strategy, how you’ll acquire customers and how you’ll convince them that they need your product. They’ll look at your team and your commitment. “We want to see the burning desire of the promoters to their business”, says Praveen, an entrepreneur turned angel investor. ‘Cayenne Consulting’, a financial consulting firm specialising in high-tech startup valuations has a form questionnaire to get a sense of the expected valuations. Although not accurate, this will serve as a good starting point for the uninitiated.

'Discounted Cash Flow' model is a traditional approach involving a lot of projections and forecasting of revenues and profits for the next 5-7 years to arrive at a number. For this reason, it isn't a preferred method for valuing startups.

Perseverance is the name of the game

So are you ready to jump in with both feet and win over those customers and investors? Unlike what TV shows like Silicon Valley would have you believe, there’s no histrionics involved (Well, not much at least. We’re looking at you, Housing. com). The investors don’t like to burn their bridges. It’s easy to quickly know whether they’re interested or not – Look at your hands. If they aren’t holding a term sheet, move on. Try again. The fight isn’t lost when you fall, it’s lost when you fail to get up. We all know the story of how Yahoo! rejected the sale of Google at its early stage; it turned out to be the best rejection the dynamic duo could have ever gotten. You’ll encounter naysayers. Smile, nod your head and go about your business.

|

Never Despair |

|---|

| 'Kaaryah’, the now popular online apparel store for women was rejected by 113 investors before securing funding from Ratan Tata, Chairman Emeritus, Tata Group. On the 365th day of sending the first mail, she finally hit paydirt. That, my friend, is perseverance. |