Growth, 14nm chips & taking down Qualcomm: Mediatek talks to Digit

With Qualcomm's failed Snapdragon 810, it's the right time for MediaTek to pounce on the market. We sat down with the company's representatives to ask them how.

Taiwanese semiconductor company MediaTek, which is also the chief competitor to Qualcomm in the market, has found a very rare chance to dig into the American chipset maker's lead in the market. We sat down with the company's General Manager, Corporate Sales International, Finbarr Moynihan, and he tells us that with its new Helio series, MediaTek is changing its image, and has the right products to take on Qualcomm. He also talked about some of the company's plans and the overall state of the smartphone market. Also, a shoutout to the custom ROM makers, MediaTek wants to work with you.

Last year there were reports of MediaTek investing $200 million in India. How’s that going?

Good, I mean, we weren’t starting in India, we already had a facility in Noida for many years. What was new was the facility in Bangalore, and I think that’s just part of the overall global expansion of MediaTek. We’re growing, our revenues are growing, our teams are growing, it’s a people business at the end of the day. So it’s about going where the talent is. For us, Bangalore was the obvious place. We already had big teams in other places, like China, Taiwan etc. so the next logical place to have a big team in was India.

Particularly in Bangalore, there’s a lot of capability in some of the areas where we’re interested, like chip development, IC development, modems etc. We’re well on our way there, we have about 200 people in Bangalore already. We opened about a year ago, and they’re already contributing to chips and designs that are going into production. So, yeah, it’s going well.

So, everybody is talking about this you know, R&D in India. What’s really different about India, from the market side?

I think in some sense it’s not that different, while in some senses it’s different. If you look at it, India tends to lag behind China — China already has ramped up 4G, while we’re waiting to see how 4G ramps up in India right? If we talk about the smartphone devices today, you can categorise it as the segmentation or the average selling prices, there’s a lag there too, like the higher tier devices tend to sell more in China.

But both are huge markets, both are very dynamic markets, both have many local needs like languages etc. What tends to be different is that in China they have a lot of their own Internet services, like Baidu, WeChat, TenCent, Alibaba and more, whereas India tends to be more aligned with western services, like Facebook, Google, LinkedIn, Twitter, they’re all very popular here. If you look at the recent data, India’s now leading in the growth of Internet subscribers.

What’s also interesting is, in India, the percentage of mobile Internet access is higher than anywhere else. The Internet access in China may be 30% mobile, while in India it might be 60% mobile. What’s unique about India is that it has the potential to be very much a mobile first Internet community, which I think creates some interesting use cases. When you think mobile first, you think about things differently — people using mobiles to search for mobiles to buy mobiles. What’s not so obvious yet is who’s going to shape that industry in India.

So you’re saying right now you don’t see anybody really driving the market in India?

Apple, Google, Microsoft, Facebook etc. drive the market in the US. In China its Baidu, Alibaba etc. and they’re driving the cloud services, mobile services, the applications, the things that people use right. But in the other parts of the world, you don’t see it as developed, not just India, but in other markets too.

Is there a difference because of the maturity of the market? China is largely considered to be a more mature market than India.

Perhaps. You know, it moves. If you think about the mobile industry, in some sense it started in Europe, with Nokia, Ericsson, Seimens etc. Now, Nokia is part of Microsoft, Ericsson is part of Sony and Europe is more about the infrastructure. But the mobile platforms have moved to the West Coast, the US with Apple, Google, Microsoft. But the mobile services are kind of there and then there's the big Chinese guys. That’s not the whole story, but that’s the way it’s going. Where next, right?

Is India the obvious answer to that? Where next?

It seems to be, right? It’s a big market, it’s a big population, I don’t want to say it’s a homogenous market, but it’s at least one country right? If you think about Africa, Europe, Latin America, the problem is those are not one country. There are so many countries, all with unique import/export duties, government taxes etc. and it’s much more fragmented. The only other market that has that kind of scale as a single market is India, I think.

Getting to the chipsets that you make, MediaTek has till now been associated with the more affordable range of mobile phones, do you plan to get into a flagship range?

Yes, absolutely.

What is your plan for that?

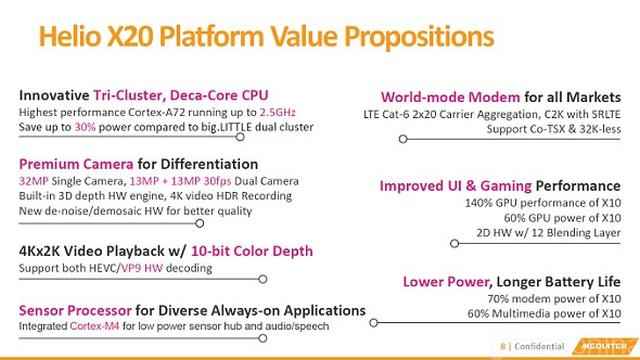

It’s very much a key focus for us. It takes a lot of technology, you have to have the CPU, GPU, multimedia etc. and we have been investing in all that. The not so well known part of MediaTek is, while yes, historically on mobile we’ve been more associated with entry and mainstream products, but we also have a very strong business in home entertainment space. We’re the number one suppliers of Blu-Ray players, Digital TVs and we’ve been very active in lot of the video standardisations.

From all of that history, we have a very strong technology base in video display, picture quality etc. A lot of that capability is now coming into the mobile platforms, like 2K displays, 4K video etc. So we’ve been able to bring a lot of that technology and integrate it into our mobile platforms. Of course you have to do certain things to bring it to this level. So it’s about, I would say, focus, changing our mindset to being a technology leader, investing in that, working closely with ARM and Imagination, and then it’s about bringing out products at the right time.

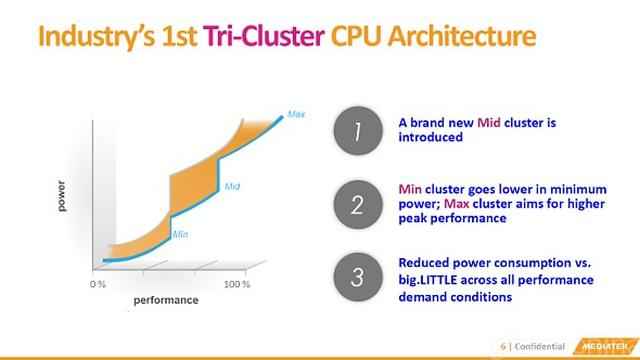

You see us starting with Helio X10, we just announced X20, which brings a whole new set of innovations with deca core, tri-cluster etc. And then the exciting thing is that we start to see brands like HTC, and you’ll see more, launching flagship products based on Helio.

That was actually the next question, What other top brands except HTC?

Right now only Chinese brands have announced Helio devices.

That’s what I’m saying, MediaTek till now has been predominant in Chinese brands, but what grade A manufacturers, like Sony etc. are working with MediaTek?

So Sony has just launched a range of products based on MediaTek and you’ll see more, LG is also launching product based on MediaTek, not the highest end, but I think Sony and HTC are probably launching higher tier products with MediaTek today. Then you’ve also got Xiaomi, Meizu, Gionee, Vivo etc., which are higher tier brands in China, who are also launching devices based on MediaTek. Only Samsung and Apple aren’t using MediaTek chipsets.

But eventually, to truly go global, you have to enter the US market right? And for that you need a solid tier 1 brand, or are you looking at the Chinese manufacturers penetrating the US market?

Both. So, one of our customers, Alcatel, just launched an LTE phone in the US market, so we’re already shipping LTE to the US market. But the US market is a different market. It’s a heavily operator subsidised market, and Apple and Samsung control quite a large part of the volume. But a few things are happening, one, operators are starting to test the limits of device subsidies. T-Mobile’s being more aggressive, but they’re starting to unbundle the price from the contract. It’s early, and isn’t a big part of the market, but I think it’s inevitable over time. That I think favours us, because then it becomes the device on its own, with the features and the value proposition.

But also, brands like Alcatel, ZTE, Motorola, Sony, LG etc. all ship to the US market, which means we’re shipping to that market with them.

Yes, they ship in those market, but like you said, LG is going to launch MediaTek driven devices, but the inexpensive ones. So it’s like when an OEM wants its devices to be cheaper, they go with MediaTek.

No I wouldn’t say that’s the case, I would say it’s about the right features at the right power and performance. I think to categorise it as cheaper is a mischaracterization. I think a lot of those brands that you mentioned, tend to have one flagship product, which tends to be today, Qualcomm (powered). That decision tends to be driven by the fact that it’s pivoted on having one platform that supports all the features globally. Today, MediaTek’s modem technology isn’t as advanced as Qualcomm’s, the X20’s modem is up to that level, but it’s going to sample later this year, so we’ll see what happens in 2016 with devices based on that.

But today, it’s platforms that we launched last year that are starting to show up on those brands. Sony is a good example, we’re in like a high-tier octa-core device, but of course, the flagship is still on Qualcomm.

Like you said, the modem becomes as powerful as Qualcomm’s with the X20, but another area where MediaTek lags is the GPU. Even the Helio X10, the performance is almost at the same level as the Exynos 7 Octa, as long as you don’t compare the GPU, say to a Mali 450.

Ok, if you’re talking about the Mali 450 then I agree with you, but I think the Helio X10 stacks up very well with any other SoC today.

It does, I thought so too, till I looked at the One M9+. As long as I’m not playing a game, it stacks up right up there, I think even above the Snapdragon 810 for that matter, but not when I’m playing. And it’s not as power efficient.

That’s interesting. Ok, fair enough, I’ll take a look at that.

Moving on, like you said, calling it ‘cheap’ is a mischaracterization, don’t you think that’s because of MediaTek doesn’t market itself enough? Like Snapdragon is a household name in India, which is saying something. Why doesn’t MediaTek do it?

Yes it’s a factor for sure. You know, Qualcomm started earlier with Snapdragon, but MediaTek started to rebrand only a year and a half ago, at Barcelona last year. And you’ll see us doing more. Helio is a whole new aspect to that. We’ve been building on that internally and externally, and you’ll see us putting a lot more emphasis on Helio in future.

But to me, Snapdragon is almost synonymous with Qualcomm. For us though, Helio is going to define an experience, we’ll have Helio and non-Helio products. So we’re taking a slightly different approach, but we’re going to concentrate that marketing and branding effort where it makes sense. I agree with you though, historically we’ve not really marketed ourselves.

And this would be the right time to do that right? You have your Helio X10, P10 and X20 right now. How would you characterise them?

Like I said, we’ll concentrate on making Helio a sub-brand of MediaTek. I personally think that with the X10, P10 and X20 in that high and premium range, we now have the products that give a pretty good run for their money to Qualcomm.

But it seems like you’re still waiting for the products to prove that?

Well, the P10 and X20 haven’t shipped yet, so yes that’s true. Those battles are being fought now, and the devices won’t show up till next year. I think we’ve changed a lot, in the past we wouldn’t have told anyone about the P10 and X20 before they actually came to the market on products, but now we’re talking about it six months in advance.

That’s also a reflection of our changed position. Because if you’re only focused on mainstream and entry devices, they move pretty quickly. But focusing on flagships, the development cycles take more time, and there’s a longer cycle. So they tend to promote earlier as well.

Next, Intel has entered the mobile market, starting to look better than they used to be. Both Intel and Samsung have worked on the 14nm processes already. Are you also working on the same?

Yes, of course we do.

When can we expect it to be announced?

Next year sometime. We announced X20 recently, so you can expect what comes next to be on the 14nm process.

Ok, moving on, the feedback we've got from a lot of people who play around with various custom ROMs is that MediaTek SoCs don’t get many of those. Why is that? Is it something on MediaTek’s end?

I don’t think so. We’re very open to working with that community if they want to, and we’re open to supporting that. I think it’s something on the ROM developers’ end.

Coming back to the SoCs, heating is a big issue in India, thanks to the weather here. But if you look at processors, they are still developed based in colder regions. The standards for the temperatures are based in those other regions, which means automatically there’s less headroom for India. So if you’re setting up R&D Centers in India, then why is this not being researched? Is it because it’s not possible?

That’s a good observation. Of course it’s possible, it’s ultimately physics. If your base is 45 degrees instead of 25 degrees, then you’ve already started higher. I think all you can do then is work on all of the aspects that can reduce the power consumption. For example, we would argue that with our Corepilot algorithm in the Helio X20, if properly used, you use the right core for the right job. So it can reduce the power consumption by about 30%.

You have to do much more aggressive power management on mobile devices. We have some innovative technologies, like our smart screen technology, which on a frame by frame basis adjusts the dynamic range pixel by pixel. It does this without adjusting the backlight, which means less power consumed. Again, these are all one of a whole bunch of tools that you’d have to throw at the problem to deal with the power consumption problem.

Do you think there’s anything to gain in educating the consumer on what you just told me?

Yes, there definitely is. But it’s quite complicated to make something like the Corepilot happen, which is our job. The algorithm profiles an application and decides which core it is to be running on. But I think you’d never be able to educate a consumer to manage that themselves, they have to trust that we’re doing our job right. But we have to sell it to them, yes.

I think for us, with Helio, it would be about really defining carefully for people what the value proposition is and what they should expect. Of course, we have to be somewhat careful, because we’re not the device manufacturer. At the end of the day, we don’t make the decisions on say, what display to use. So it will be in conjunction with the brands, particularly in those high-end phones, where it’s going to be more limited brands.

In terms of the brands that are associated with the MediaTek, how big a role do Chinese brands play in your future?

Six of the top 10 smartphone brands today are Chinese brands, so inevitably they are an important factor in the market going forward. But you know, now Micromax starts to bubble into that top 10-12 level, so it’s like watch this space, right? I think for anybody in this business, the Chinese brands are going to be a big factor in this market globally, that’s just how it is.

So considering Apple and Samsung to be tier I brands, do you think that the tier II brands are the ones to look out for right now? Or is the gap really as big as a Samsung would have you imagine? I think Apple can be considered to be a step ahead with their vertically integrated system?

Yes, I think I tend to see Apple as a special case, but Samsung is also a formidable company. They have in house processors, displays etc. which gives them scale, and a lot of advantages. Plus, on a global basis the amount of dollars Samsung spends on branding is significant. So there’s a halo effect of the Samsung brand, and I think that’s a special position that they have.

If you look at the market, it’s like Apple and Samsung, and then the others, in terms of volume at least. But that’s still quite dynamic, you have Lenovo, Huawei, Xiaomi etc. who are all selling plus or minus 80-100 million units a year. They have their respective strong markets, but it’s a little bit patchy for them right now. That’s the opportunity for them to establish a more global footprint, which isn’t easy, but that’s where I think it’s going.

But do you see a Samsung losing its grasp on the market in say 5 years? So right now it’s at 80-20, do you see it becoming 60-40?

I still think of Samsung as a pretty formidable company, there’s a depth of product technology. They drive a lot of the stuff in-house, which gives them a lot of advantages I believe. Plus the brand I think is very strong and they spent a lot of money on it. But I can’t predict what’s going to happen in the market in a year, let alone five years. I expect more growth from the China brands, at the expense of who, I can’t predict.

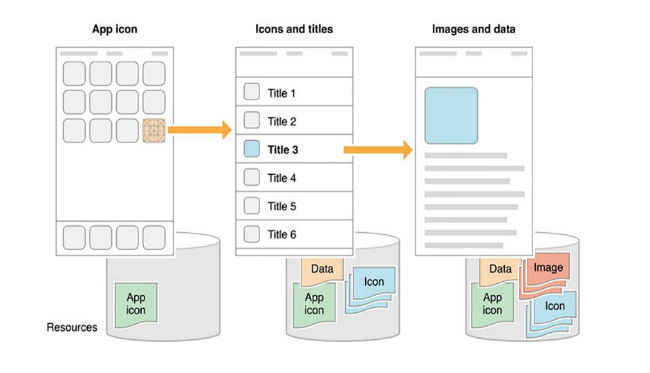

So I’m sure you’ve heard of App Thinning that Apple introduced in WWDC15 this year. Do you, as a chipset maker, think it’s possible in Android, with so much fragmentation?

It’s definitely more challenging, and not easy. I can’t imagine that.

Last question, moving away from phones, what are your initiatives in IOT right now?

Obviously it’s a very important part, and it’s like the next big thing, but we don’t tend to look at it as a homogenous market right now. So for example there were wearables, and we’ve now created a separate business to focus on wearables. We just finished Computex in Taiwan last week, and one of the big areas we were talking about there was home automation. We think that’s an important category of the IOT market.

We believe we have pretty much all of the core technologies, and I think we’re one of the best companies in SoC integration. So, integrating low power CPUs, multimedia, connectivity, RF, we’ve done that for many, many years and it is going to be important, particularly when these products become high volume but lower price. So we’re focusing on it segment by segment.