Is Intel about to become Apple’s ARM SoC foundry?

If an industry analyst is to be believed, Apple may soon move the production of its ARM processors from Samsung to Intel. This dovetails neatly with the news earlier in the year that Intel was moving into the foundry business — but it isn’t quite that simple: The same analyst says that, as part of the deal, Apple will have to transition its iPads away from ARM to an Intel x86 SoC.

This information comes from Doug Freedman, an analyst at RBC Capital. The exact details are as follows: Intel would take on the production of the ARM SoCs found in the iPhone (and presumably the iPod); in exchange, Apple would switch to an x86 SoC in the iPad.

According to Freedman, Cupertino is already in talks with Intel, but we should stress that nothing is confirmed. At first blush, you might think this development is completely insane — and to be honest, it really is. There could be a grain of truth, though. We know that there have been growing tensions between Apple and Samsung (which currently manufactures every iPhone/iPad SoC), due to patent warfare and increasing competition in the consumer electronics space. Over the last few months there have been numerous rumors that Apple would move its A-series SoCs from Samsung to another foundry.

The question has always been, though, who would take on the fabrication of Apple’s SoCs? With a volume of around 100 million chips per year, there are only a few possible choices, once you remove Samsung from the equation: TSMC, GlobalFoundries, and Intel. Most analysts and pundits originally assumed that Apple would move to TSMC, but there are lingering questions about whether TSMC has the spare capacity to continue producing chips for Qualcomm, Nvidia, and AMD, while taking on another 100 million from Apple. GlobalFoundries is a possibility, especially if Apple stumps up some capital investment for additional capacity at an advanced process node.

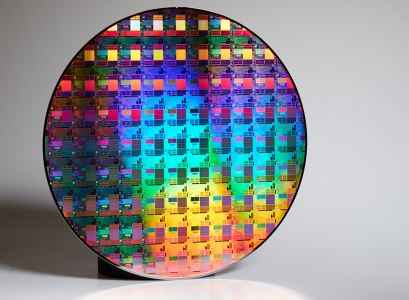

And then there’s Intel, with its fancy, industry-leading, 3D FinFET 22nm process. Earlier in the year Intel announced that it had begun producing chips for Achronix and Tabula, two small-time FPGA makers — the first time that Intel has acted as a foundry (manufacturing chips for third parties). Apple is a whole different ball game, though. With Achronix or Tabula we are talking about tens of thousands of chips — with Apple, it would be hundreds of millions. Would Intel really take on Apple’s SoC business? Intel probably has the capacity, and through the FPGAs it has shown that it has the technologies and processes to act as a foundry.

The main thing to remember, though, is that switching from Samsung to Intel (or TSMC or GloFo) would be a massive move for Apple. Changing from one process to another (say, from 45nm to 32nm) can take months to move from design, to tape-out, to actual production — but moving from one foundry to another is a gargantuan task. Apple’s chip designers have intimate knowledge of Samsung’s foundry work flow: The limitations of the HKMG process, the caveats of the software, and other gotchas that can only be uncovered through experience. Depending on Intel’s foundry work flow, such a switch could take a very long time to execute.

An iPad, with an Intel Inside stickerIf Apple does move, though, there’s a lot of money at stake. Freedman estimates that Apple’s chip business to be worth $2 billion per year (415,000 wafers at $5k each) — a sizable sum, though still only a fraction of Intel’s $55 billion annual revenue.

For me, though, the biggest giveaway that Freedman’s sources are incorrect is that tidbit about Intel forcing Apple to move its iPad to x86. It certainly makes sense from Intel’s perspective, which is desperately trying to break into the mobile market — now with Clover Trail, which is fairly exciting, and next year with Bay Trail, which will probably blow the doors off everything else on the market. I’m not sure if I can picture Apple splitting its iOS platform into two different architectures, though, just to get into bed with Intel. Maybe that’s the only option, though, if Apple really wants to drop Samsung and TSMC doesn’t have the capacity.