UPI has unlocked an unprecedented wave of financial activity all throughout the country, ensuring everyone from the roadside vegetable vendor to premium supermarkets, from auto-rickshaw wallahs to all major airlines have embraced the highly convenient mode of transferring money.

So when I heard news of India starting a trial of its official digital currency – the e-Rupee – I was curious to know how it will differ from all the “digital money” we’ve been sending and receiving from our UPI apps for the past few years. More importantly, what new areas of financial inclusion will it help enable, ensuring the poorest of poor Indians benefit from the transformative power of technology.

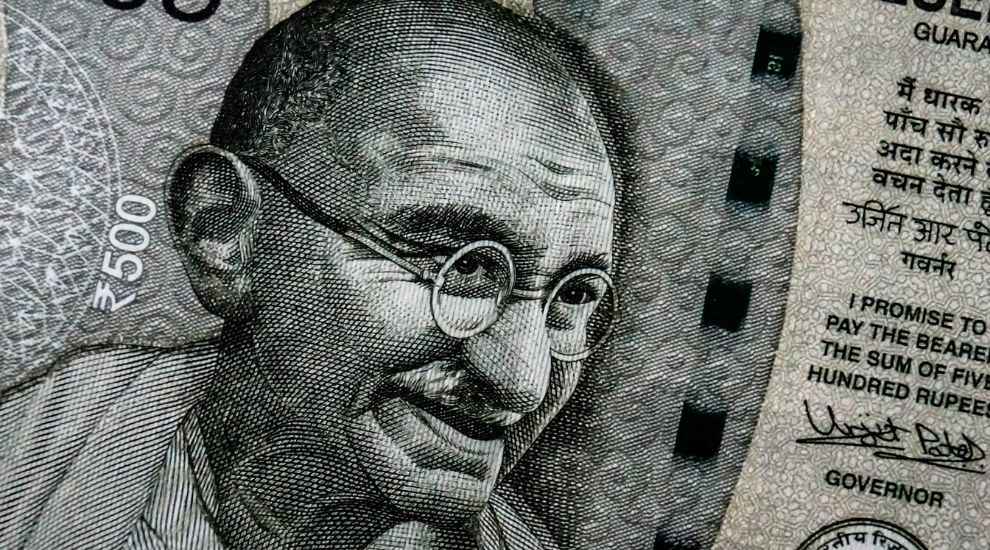

The Reserve Bank Of India (RBI), which is the ultimate guarantor of currency payments in the country, has started a pilot project of digital currency e-Rupee between itself and all other banks operating in India. Also known as the Central Bank Digital Currency (CBDC), the digital rupee (e-Rupee) carries the same value as paper money or coins in your wallet, it’s just a digital version of the traditional money we’ve been using all this while with all the transactional benefits of all other forms of digital money transactions we’ve been undertaking through UPI or net banking.

Don’t Miss: CBDC roll-out in different countries around the world

Details are still hazy at the time of writing this, but as I understand one of the main differences between the RBI issued e-Rupee and traditional cash or digital money we’ve been using to settle trades till now is the absence of a middle-man. For example, where do you go to claim all the money that belongs to you? The banks where you have an account with all your money in it, of course. Whether it’s a cheque deposit or stocks liquidation, making e-commerce payments or your employer’s monthly salary credit, all forms of money start and end at one or the other bank. All these existing forms of accessing and using money – whether in cash or digital format – isn’t going to disappear, but with the introduction of e-Rupee some forms of money-related matters will be settled directly with the RBI instead.

When you add or remove money from your bank account, whether through UPI or by another way, you’re adding or removing money from your account with that bank – not directly through the RBI. But with the digital rupee transactions, retail use (which means use of digital rupee by common people like you and me) of the e-Rupee will appear directly in RBI’s balance sheet.

Printing money is costly, carrying it everywhere in your pocket comes at the risk of loss, and its illegal or counterfeit use is detrimental to the economy – all these issues can be fixed with the help of a digital e-Rupee coming along.

But one of the most interesting features of the CBDC or digital rupee is that people without a bank account will still be able to transact with it – how exactly this will happen remains to be seen. I don’t think banks will be too happy to be cut-off from the financial chain entirely, nor can the RBI afford to fully replace all national and private banks operating in the country, but it’s still an interesting development.

Also Read: What is ONDC, Indian e-commerce's UPI moment

Just like UPI apps act as an aggregator of all retail banking transactions in India, maybe for the digital e-Rupee there’ll be specialized apps for transacting with them at the RBI level. However, I’m certain the e-Rupee will be aimed at filling gaps in the banking sector – not to bypass it completely.

Imagine government agencies taking a token from a service provider by paying them in advance, and handing the token to people who are on their list of beneficiaries – people who exist but don’t necessarily have a bank account. These tokens would be delivered as an SMS or a QR code to the beneficiaries. They can be redeemed for providing healthcare services in rural areas, for example, slowly expanding into other avenues like education, where students would be handed education tickets for school fees and so on. All of this is for the upliftment of the poor who have access to a phone and cheap internet connection, but don’t necessarily have the wherewithal to open and maintain a bank account.

How do you think we will all use e-Rupee in the near future? Let me know…

This column originally appeared in Digit’s November 2022 print edition under the title of ‘e-Rupee will set you free’.

For more technology news, product reviews, sci-tech features and updates, keep reading Digit.in.