AMD and NVIDIA Begin U.S. Chip Production at TSMC’s Arizona Fab

In a significant step toward reshoring advanced semiconductor manufacturing, both AMD and NVIDIA have begun production of their latest generation chips at Taiwan Semiconductor Manufacturing Company’s (TSMC) facility in Phoenix, Arizona. The move not only reflects the growing strategic importance of chipmaking to the U.S.’ national economic and technological agendas but also highlights the maturing capabilities of TSMC’s U.S.-based fabs.

AMD’s U.S. Manufacturing Push

Advanced Micro Devices (AMD), long reliant on TSMC’s cutting-edge fabrication in Taiwan, is now turning to the Taiwanese foundry’s American operations to produce next-generation silicon. CEO Dr. Lisa Su confirmed the commencement of production during a media interaction at National Taiwan University in Taipei, stating that AMD is “ready to start chip production” at TSMC’s Arizona facility.

The decision to move part of its production pipeline to the United States aligns with AMD’s broader objective to enhance resilience in its supply chain—particularly for AI and data centre components, areas where demand is surging. Dr. Su also noted that the company would “certainly make more AI servers in the U.S.,” suggesting a localisation of not just chip fabrication but also downstream assembly and deployment.

This shift comes at a time when geopolitical pressures and trade dynamics, including potential new tariffs on imported semiconductors, are pushing U.S.-based chip designers to seek domestic manufacturing alternatives. While AMD has not disclosed which specific products will initially roll off the lines in Arizona, industry watchers expect AI-focused processors and high-performance computing (HPC) chips to take precedence.

NVIDIA Begins U.S. Production of Blackwell Chips

Meanwhile, NVIDIA has officially begun production of its Blackwell architecture chips at the same TSMC plant in Phoenix. The announcement marks a notable evolution in NVIDIA’s supply chain strategy, as it works to bring a portion of its advanced AI GPU manufacturing closer to its major North American customers.

The company revealed that production is underway for Blackwell chips using a custom TSMC 4NP process, a node that is most likely a derivative of TSMC’s N5 process. However, it remains tight-lipped about whether this includes the top-end Blackwell Ultra GB300 GPU, which was introduced earlier this year.

The manufacturing in Arizona is being supplemented by local partnerships for packaging and testing, with companies in the region providing backend services. This localisation strategy is complemented by NVIDIA’s upcoming supercomputer production plants in Texas, developed in collaboration with Foxconn and Wistron. These facilities are expected to ramp up to full production within 12 to 15 months.

“Manufacturing NVIDIA AI chips and supercomputers for American AI factories is expected to create hundreds of thousands of jobs and drive trillions of dollars in economic security over the coming decades,” NVIDIA said in a statement. While the numbers may be ambitious, the sentiment underlines a renewed focus on building domestic capacity for AI infrastructure at scale.

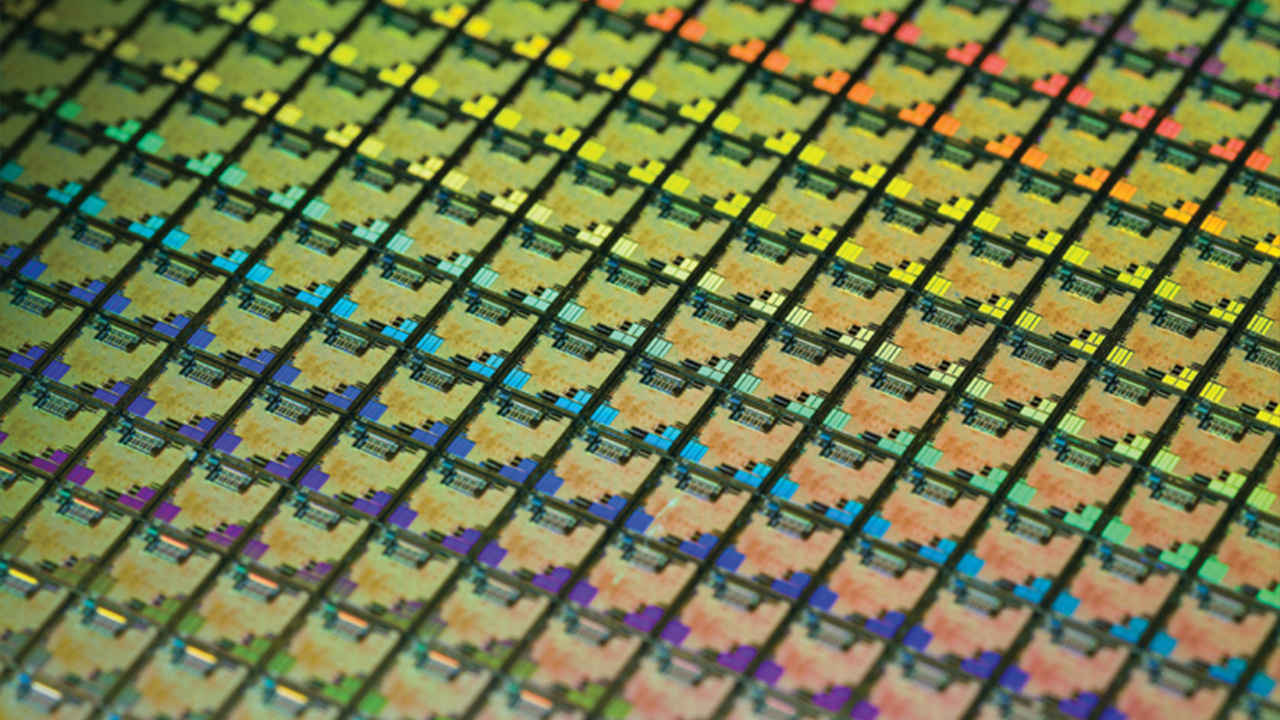

TSMC’s Arizona Megasite

All of this is made possible by TSMC’s aggressive expansion in the U.S., which began in 2020 with a $12 billion commitment to establish an advanced semiconductor facility in Phoenix. Since then, the investment has ballooned to over $65 billion, encompassing three fabs and extensive government support through the CHIPS and Science Act. The initiative represents the largest foreign direct investment in Arizona’s history and the largest greenfield FDI in the United States.

The first of these fabs began volume production in Q4 2024, deploying the N4 process technology, which matches the yield rates of TSMC’s mature facilities in Taiwan. The second fab, under construction, will house the 3nm N3 process and is expected to become operational by 2028. A third fab, announced in April 2024, will manufacture 2nm—or potentially even more advanced—chips by the end of the decade.

The strategic significance of these fabs extends beyond the corporate interests of AMD and NVIDIA. For the U.S. government, the TSMC Arizona site is a keystone in efforts to restore domestic semiconductor leadership. With each new fab, TSMC Arizona is expected to add thousands of direct and indirect jobs, and support advanced applications across mobile, AI, and HPC sectors.

Building a resilient supply chain

The move by AMD and NVIDIA to produce at TSMC Arizona also signals a broader realignment in the global semiconductor supply chain. Traditionally concentrated in East Asia, especially Taiwan and South Korea, advanced chip manufacturing is now being more evenly distributed—albeit slowly and with substantial cost premiums.

For companies like AMD and NVIDIA, the calculus includes not just cost and yield, but supply chain stability, regulatory compliance, and geopolitical resilience. While TSMC’s Arizona fabs are not yet at the same scale as their Taiwanese counterparts, they are a critical hedge against regional risks and a platform for closer integration with North American OEMs and hyperscalers.

As AI becomes increasingly central to national competitiveness and digital economies, the production of AI and HPC chips on U.S. soil gains symbolic and strategic importance. For now, AMD and NVIDIA’s foray into domestic manufacturing at TSMC Arizona appears less about capacity shift and more about positioning—for future resilience, for regulatory alignment, and for long-term access to cutting-edge process technologies without relying solely on offshore fabs.

Mithun Mohandas

Mithun Mohandas is an Indian technology journalist with 10 years of experience covering consumer technology. He is currently employed at Digit in the capacity of a Managing Editor. Mithun has a background in Computer Engineering and was an active member of the IEEE during his college days. He has a penchant for digging deep into unravelling what makes a device tick. If there's a transistor in it, Mithun's probably going to rip it apart till he finds it. At Digit, he covers processors, graphics cards, storage media, displays and networking devices aside from anything developer related. As an avid PC gamer, he prefers RTS and FPS titles, and can be quite competitive in a race to the finish line. He only gets consoles for the exclusives. He can be seen playing Valorant, World of Tanks, HITMAN and the occasional Age of Empires or being the voice behind hundreds of Digit videos. View Full Profile