The geek’s guide to money management apps

Does your head bursts trying to keep track of your income, expenses and investments over the past month and year? Even if you’re not the type who needs any assistance with numbers, having your expenditure and bills automatically tracked and reminded, never really made anyone’s life harder. That is exactly what a host of services in the form of smartphone apps and websites are offering you now, with little or no effort from your side. We went through a bunch of them and here are the ones we found useful.

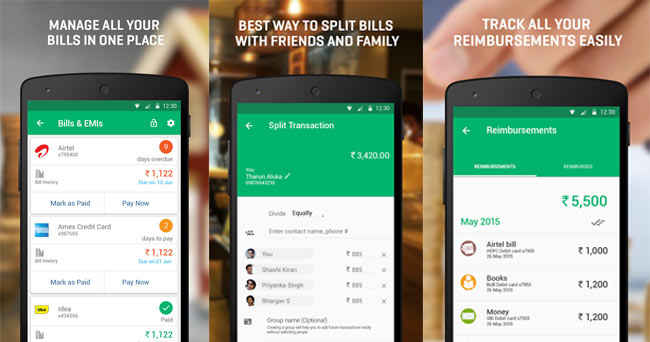

Walnut

Broadly an expense and budget tracker with SMS analysis capabilities, Walnut has a category analysis feature and also, groups your transactions accordingly. In the analytics area, you will get compiled pie-charts of expenses of each time period, grouped into categories, as well as rankings. Some features which distinguish it are the ability to enter comments for each transaction, attach pictures of bills to each transaction, and to read the SMS from within the app. It can additionally detect online transactions separately and highlight them. Also, the notifications are amazingly useful, showing you the percentage of spending left in each category.

If you are looking for more detail in the automatic categorisation and would like more comprehensive analytics that lets you compare specific categories across months, WealthPack is a similar and better SMS analysis based app.

Zoho

This one isn’t an SMS expense tracker. You have to manually enter and categorise your expenses then enter the merchants in Zoho expense tracker. Then why is it even here? It has a report oriented approach which lets you generate reports for entire trips or certain days with an option to mark each transaction to be claimed as reimbursement. A very useful feature is the app’s ability to scan a receipt and retrieve the data from it.

Expense Manager

Even though the UI on this app is not as friendly as the other alternatives, the overall approach is very professional. You have to enter data and modify categories manually but there’s no automatic detection. The graphs and charts this app can generate are at par with professional options with charts classified by category, subcategory, time period, etc. You can also mark payments as cleared or uncleared, attach pictures and define the payee in each payment. If you are looking for a powerful tool and don’t want the app to auto-detect stuff, Expense Manager is totally what you should go for.

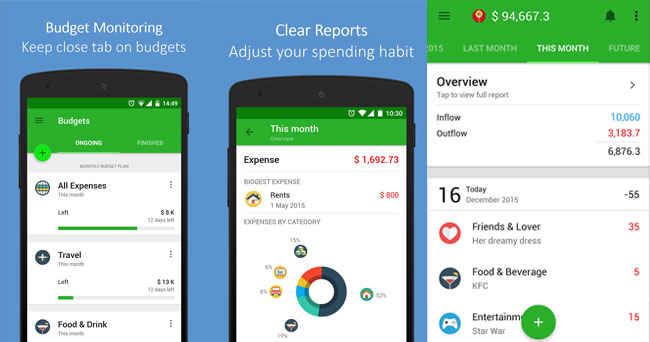

MoneyLover

Out of all the apps we tested, MoneyLover has the most persistent notification settings that we could find. It constantly shows you the current amount of money you are left with on the notification screen. Although it does not auto-detect your transactions and requires you need to enter them manually, the material design makes that task quite easy. MoneyLover makes up for it in the amazingly useful budget settings allowing you to set spending and saving targets.

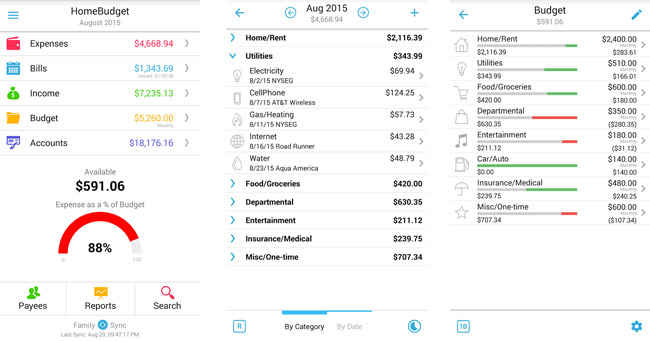

HomeBudget

Similar to Expense Manager in terms of entering data and MoneyLover in terms of usability, HomeBudget also allows you to create groups with Family or Friends using HomeBudget and managing a common budget. It allows you to customise categories and groups with icons of your own. It also lets you save reports. A fair warning would be its lack of proper analytics tools. The charts and summaries in place seem half-hearted.

Monefy

Possibly one of the best user interface’s that we have come across, Monefy doesn’t really boast of ground-breaking money management capabilities. You simply tap the ‘+’ or ‘-’ to indicate an income or expenditure and categorise it accordingly. The moment you enter a transaction, the home screen is loaded with your transaction flashing at the centre before it disappears. Following that all the categories around it are updated accordingly with lines pointing to the pie chart at the centre.

MoneyView

Another Indian origin SMS analytics based expense tracker, MoneyView doesn’t detect transaction categories but ends up categorising most of the transactions under a broad “Debit Card” category. Although weak on this point, a strong point of this app is the ability to pay your bills from within the app, even though the app could not detect all my bills that other apps had detected. You can also mark your transactions as reimbursable and track them in a separate header altogether. But you would still need something like the Zoho expense manager to generate useful reports of those reimbursements.

MyUniverse

From the Aditya Birla Group, MyUniverse gets all its points for the concept; the execution lacks things like incorrect bank names and slow transaction updates. One more point, this app needs to log into your bank (via your internet banking credentials), credit card (via card number and PIN), investment account (via credentials) and any other accounts. Although the website does proclaim that its transactions are secured by Verisign, a user may not be comfortable sharing this level of details with an app. It even has an additional tool called ZIPSIP to invest in mutual funds online.

Tax Calculator India

Tax Calculator India app does what it says – it calculates tax. A no nonsense calculator, it allows you to simply enter your annual income and declare your investments in categories such as medical, education loan interest, house rent etc. The sliders to set the amounts are quite handy. Once you have entered the amounts, the tax breakup page shows you exactly why you are paying the amount of tax you are paying.

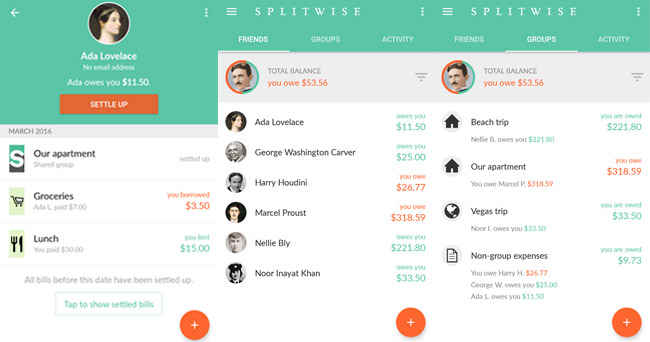

Splitwise

When it comes to splitting bills between a group of people, there is no other app as easy to use as this one. Splitwise syncs with your Google+ account contacts and allows you to add friends into the app (when you add people who are not using the app, they receive an invite). Once they are added, you can create any bill and split it in whatever way you wish to between any number of friends on the app. The home-screen will show a nifty summary of how much people owe you or how much you owe others.

Google Sheets Budget Template

This is not an app. It’s just a spreadsheet template that you can use in Google Sheets. There is one for monthly budgets and one for yearly budgets. The monthly budget sheet has all the formulas in place and you only need to enter your transactions in the second sheet and categorise them. The first sheet keeps updating based on what you enter and shows your overall savings, your actual expenditure against your planned expenditure for categories and overall. This is a simple and easy to use tool that you can seamlessly download as an excel sheet. The data from the monthly budget can be input into the yearly budget sheet to generate trend charts.

Google Now

Even though Google’s smart AI is not a dedicated money manager, it does a pretty good job of detecting your pending bills from your emails and SMS inbox and reminds you of the same through its cards when they are due. This comes in very handy because Google Now is deeply integrated into Android and might even feature integrated bill payment options in future updates. Along with that, if you have entered the stocks that you are interested in, you will also have a card showing the value trends for those stocks. The usefulness is that you would probably check Google Now regularly.

MoneyControl’s Markets on Mobile

MoneyControl's app is a dedicated stock market app which can be very useful to someone with a keen interest in stocks. It provides useful general categories such as ‘Market Movers’, ‘Top Commodities’ etc., and allows you to track your own stocks once you have registered as a user. It is quite easy to use once you dedicate a little time to understand all the options available on the app.

As of now, there is yet to be an overall solution for India similar to what Mint is for the US – budgeting capabilities, transaction tracking, bank integration, investment recommendations, bill payment and credit rating, all rolled into one. The one that comes closest according to us is Walnut, which lacks the firepower of bill payment and investment capabilities, but is very good at tracking, budgeting and providing detailed breakdown of all your transactions.

Payment Aggregators

Since the major e-commerce boom in India, one of the most significant changes in the way money is handled has been the rise of payment aggregators and digital payments. It has created a familiarity between people and internet banking and people are now willing to take care of most of their purchases, bookings and bills digitally. This has created the market for payment aggregators and the market is filling fast with options where some are good, and others, not so much. Some of the interesting payment aggregators have been covered here.

Your Bank’s Mobile App: The mobile apps from most major Indian banks now have the ability to settle utility bills and do recharges within the apps itself. A major perk of using the mobile app of your own bank is that you don’t have to trust any third party with your account credentials and authorisations go through very smoothly. Needless to say, options might be limited compared to dedicated aggregators.

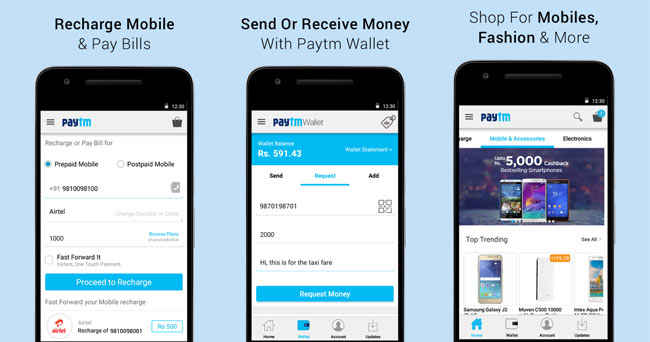

Paytm: From one of the first independent online recharge options to being well on the way to becoming India’s spiritual equivalent of Paypal, Paytm’s truly showed up on the map when it integrated with Uber as the only payment option. Paytm deals with utility bills as well as ticket bookings, but just like most other dedicated payment aggregators, suffers from a limited number of states covered. With the largest user base, it is majorly known for the cashbacks it offers. Although it does cover most grounds, it still doesn’t provide a card that can be used for payments. You can opt for Freecharge that has the option to avail a Freecharge Go MasterCard.

One of the major reasons to use payment aggregators is the reduced dependency on the bank as your sole money management institution. There’s an increasing complication in the payment scenario online, with credit cards, debit cards, gift cards, online banking, payment gateways for your electricity bills, mobile bills, DTH bills, ticket bookings etc. A simplified payment aggregator that brings it all under one roof can help you save a lot of time.

Now that you have all these apps and web-tools at your disposal, pretty soon you should be saving a ton of money and suddenly turn into a financial guru, right? Unfortunately, technology still hasn’t completely replaced the need for your actual intentions. With the right tools, you just need to have the actual intention of saving money rather than expecting the app to do it for you. Then, and only then, will you be rid of the woes of month-end and tax seasons. So get that smartphone out, roll those sleeves and get ready to save!

This article was first published in the March 2016 issue of Digit magazine. To read Digit's articles first, subscribe here or download the Digit e-magazine app.