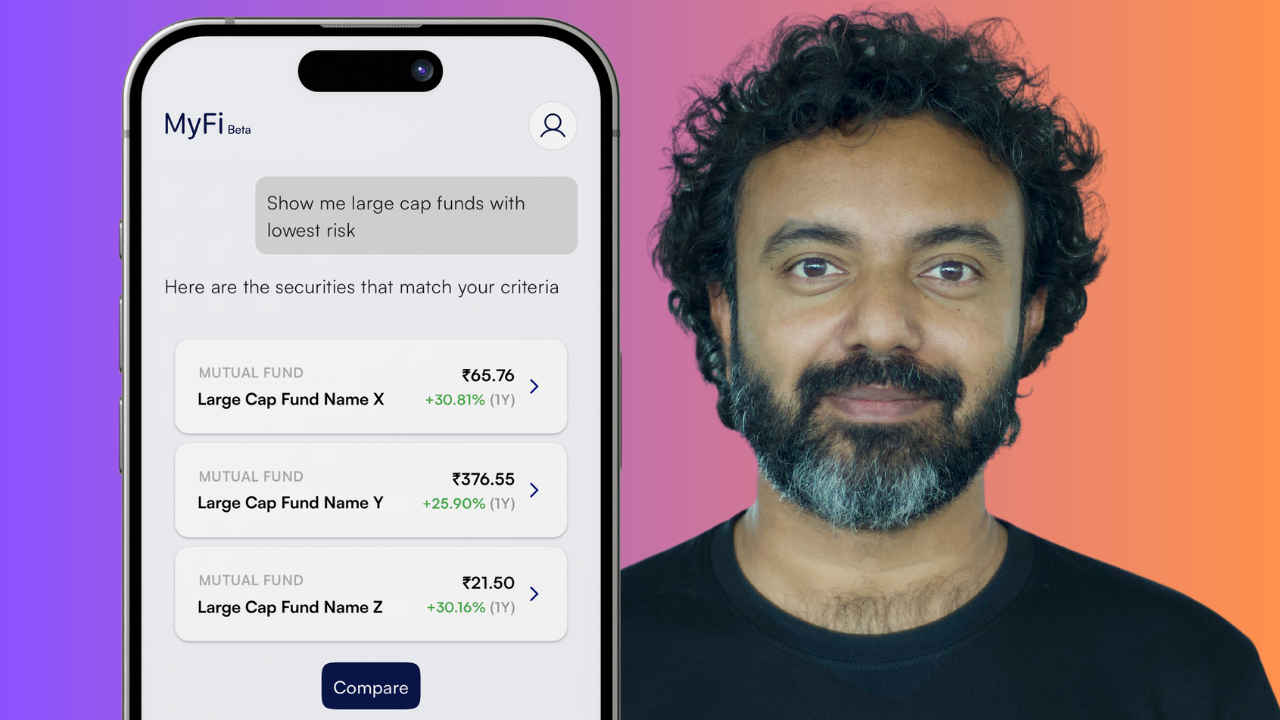

Meet MyFi, an AI-based personal finance app powered by LLM for wealth generation

Imagine a personal finance management app that you only interact through an AI-powered chatbot and you wouldn’t be too far off the mark from MyFi. In a world where investment apps have traditionally doubled as trading platforms, allowing users to buy and sell stocks with a few taps on their smartphones, MyFi, a new entrant backed by TIFIN, is charting a different course, according to its co-founder and CEO.

Survey

Survey“MyFi leverages a combination of AI models to deliver personalised investment recommendations. In essence, MyFi leverages AI to provide a transparent, accountable, and unbiased investment experience by combining human financial expertise and leveraging AI, to prioritise financial success of our users and adapting to their evolving needs,” said Kiran Nambiar, Co-founder and CEO of MyFi.

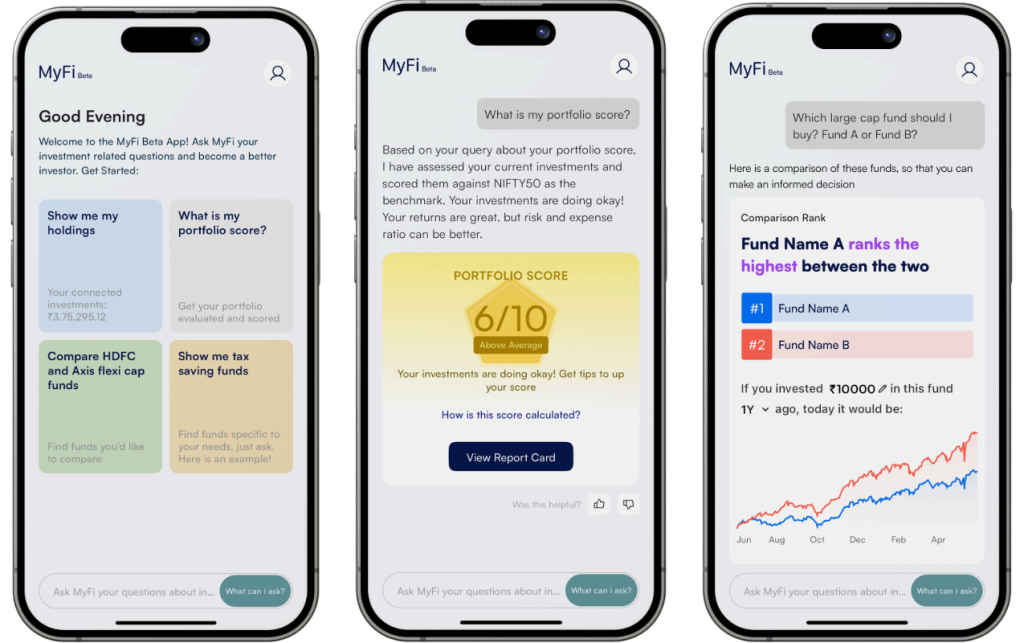

MyFi claims to be India’s first conversational AI assistant dedicated to long-term wealth creation. Unlike most other investment apps that charge trading fees from users, MyFi’s incentive is to only front personalised investment advice through high-quality research through an AI-powered chatbot, all for a monthly subscription fee of ₹299.

“Think of the app as an assistant who not only gives you options based on market realities but does so in the context of your current investment portfolio, all in conversational form and in a simplified language you can understand,” according to Kiran Nambiar.

MyFi is registered with SEBI as a Registered Investment Advisor (RIA) and is operating in strict accordance with all relevant government regulations, emphasised Nambiar. The fundamental user problem it’s trying to solve revolves around mutual funds.

You don’t need me to tell you how millions of Indian investors are actively investing in mutual fund schemes, thanks to a big role played by SIPs (Systematic Investment Plans). Not just exciting opportunities, there’s severe complexities and cautionary tales to curb your reckless enthusiasm in this space – just look at all the legal disclaimers of every MutualFundsSahiHai.com advert on TV! Nambiar believes this segment can’t be adequately addressed only through human interaction given the sheer volume of investors, making it ideal for customised and personalised investment advice that only AI-powered systems can provide. This is where MyFi enters the financial landscape hoping to disrupt the space with AI and guide individual investors to navigate their long-term financial goals.

Also read: Why Confidential AI is on the rise: Intel’s Anand Pashupathy explains

While he didn’t reveal the exact foundational model(s) powering MyFi’s chatbot layer, Kiran Nambiar did explain what happens behind the scenes. At the core, the LLM provides a chat experience that goes on to understand user questions. This user understanding is then passed to sophisticated financial models which are based on deterministic values. “These financial models have been built and back tested over years by our team of seasoned investment professionals, considering market data, historical trends and various factors. The information is then fed back to the LLM to generate personalised responses with the recommendations from our models that’s tailored to the user,” he explained.

It’s interesting that MyFi is wholly AI-powered, free from human bias at the customer interface level, according to their claims. But what about AI bias and hallucination impacting their investment advice?

MyFi prioritises unbiased and fair recommendations through a combination of data transparency and human expertise, Nambiar said. “Our financial models are built entirely on empirical data, like historical market performance and investment characteristics. Our recommendations focus solely on aligning user portfolios with their financial goals for better wealth outcomes. While LLMs play a crucial role in understanding user needs, investment decisions come from these sophisticated quantitative models overseen by our experienced investment team. These models are deterministic, meaning their outputs are based on clear logic and data, and will not change unless there is a change in input. This eliminates the risk of hallucinations or other challenges that LLMs can face. Moreover, our investment team constantly evaluates and improves these models with new data, ensuring guidance stays relevant as market conditions evolve,” he emphasised.

As far as the source of their data that feeds into their financial models, it comes from a wide variety of trusted sources. Being a SEBI registered Investment Advisor (IA), MyFi gets the latest regulatory updates directly from SEBI, which it constantly reviews to inform product update cycles, according to Nambiar.

“Our models leverage daily updates from mutual fund data providers to constantly be informed. This not only ensures user investment scores are dynamically recalculated, but also triggers a comprehensive portfolio analysis. We go deeper than just basic price points, we research the investment landscape, exploring how investments are distributed across various market capitalizations (small, mid, large cap), sectors, and themes,” he explained. Nambiar further emphasised that MyFi incorporates data across multiple timeframes within its models for a long-term perspective on financial growth, going on to analyse investment options beyond basic factors, considering a wide range of parameters such as returns, risk, expense ratios, sector exposure, and asset types. All this to ensure that every MyFi user’s portfolio stays aligned with the evolving market landscape, with AI-powered recommendations tailored to the specifics of their individual portfolio alone.

All said and done, when it comes to matters related to people’s money and dispensing financial advice, transparency and user trust is everything, and MyFi’s Kiran Nambiar gets it. “As a SEBI registered Investment Advisor (IA), we adhere to strict compliance regulations. Every decision and recommendation is thoroughly documented, creating a clear audit trail that details user inputs, recommendations, and data analysed to provide those recommendations, allowing for a comprehensive review and ensuring accountability in our advice,” he mentioned.

Also read: AI impact on cyber security future: The good, bad and ugly

Data security is another top priority for MyFi, as it employs industry best practices to safeguard user data throughout its lifecycle, according to Nambiar. Data transmission is encrypted using SSL protocols to ensure secure transfer to our servers. Upon receipt, all personally identifiable information is encrypted with a 256-bit asymmetric key encryption. Additionally, databases reside within a VPC, accessible only by authorised servers that require data retrieval. All APIs returning sensitive information to the application undergo user token authentication.

“This approach ensures that not only is a valid token required for data access, but also prevents unauthorised access to another user’s data even with a valid token. Our commitment to security extends beyond the basics. We leverage a load balancer and firewall on our cloud infrastructure to mitigate DDoS attacks. All of this ensures that our systems are built for scale while securing your data. Building on this foundation of security, we have established systems to continuously monitor the accuracy and performance of our models and system responses. These undergo manual review on a weekly basis, ensuring not only their continued accuracy but also their persistence in delivering optimal recommendations,” Nambiar explained.

MyFi’s long-term vision extends far beyond simply being an investment assistant. “We aspire to become a wealth assistant, empowering the masses in India to build long-term wealth and achieve better financial outcomes. This is fuelled by the opportunity created by India’s burgeoning digital landscape, a growing middle class that translates into a larger investing user base, and the increasing accessibility of AI and other technologies,” summarised Nambiar.

As we ponder the future of AI in personal finance, MyFi tries to transform complex financial decisions into accessible and user-friendly experiences. Launched on July 1 in public beta, MyFi is compatible with both Android and iOS. Its monthly subscription price is ₹299, although the first 1000 subscribers will get it only for ₹99 monthly.

Jayesh Shinde

Executive Editor at Digit. Technology journalist since Jan 2008, with stints at Indiatimes.com and PCWorld.in. Enthusiastic dad, reluctant traveler, weekend gamer, LOTR nerd, pseudo bon vivant. View Full Profile